crizac share latest news

Market Debut – A Strong Start

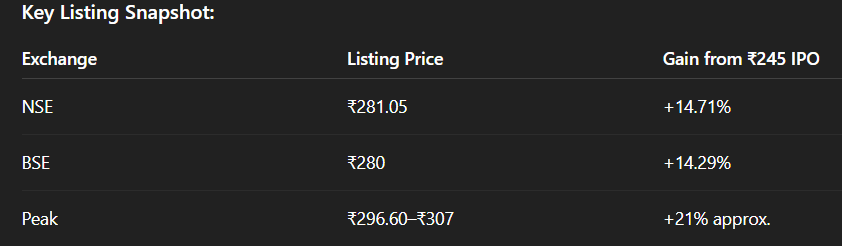

Crizac, a B2B education‑technology firm focused on international student recruitment, made its bourses debut on July 9, 2025, and the response was emphatically positive:

-

Listed at ₹281.05 on NSE – a 14.71% premium over its ₹245 issue price .

-

BSE debut at ₹280 – reflecting a 14.29% gain .

-

Momentum carried the stock even higher: trading reached ₹296.60 on NSE—a 21% climb from IPO price .

-

Subscription & IPO Details

-

IPO open: July 2–4, 2025, price band ₹233–₹245 .

-

Total size: ₹860 crore (Offer for Sale only), promoters Pinky & Manish Agarwal sold ~3.51 crore shares .

-

Oversubscription rate: ~62.9× overall; Retail: 10.7×; NIIs: 80×; QIBs: 141× .

-

Raised ₹258 crore from anchor investors on July 1 .

-

Business Model & Fundamentals

Founded in 2011, Crizac operates a proprietary B2B education‑tech platform that connects global education agents with universities across:

-

UK, Canada, Ireland, Australia, New Zealand .

Key facts:

-

Processes applications from 75+ countries, for 135+ educational institutions, with 5.95 lakh+ student applications in FY22–Sep 2024 .

-

FY25 financials (up to Mar 31, 2025): Revenue ~₹884.8 cr, Profit After Tax ~₹152.9 cr; EBITDA margin ~25% .

-

Market cap post-listing: ~₹4,760–₹5,200 cr, reflecting investor valuation of a high-growth edu‑tech play.

The company’s strong growth (CAGR ~76% over three years) and profitability position it as a standout among education‑services peers .

-

-

crizac share latest news -

Investor Strategies

If you were allotted shares:

-

Many experts recommend locking in some profits—e.g., sell 25–50% of holdings at current elevated prices.

-

Maintain a core holding if you believe in Crizac’s long-run fundamentals.

For new investors:

-

Consider accumulating on dips—if price retreats to ₹270–₹280 range, it may offer a good entry point.

-

Watch broader IPO trends: if sentiment weakens, Crizac could decline too, but strong business metrics may provide support.

-

Expert Commentary & Market Sentiment

-

crizac share latest news -

-

Moneycontrol: Analysts advise those allocated shares to consider booking partial profits, while holding the rest for potential further upside .

-

AVP at Hensex Securities, Mahesh Ojha: Suggests “long-term investors may continue holding… New investors should consider accumulating the stock on dips.” Also notes market confidence supports fundamental strength .

-

Economic Times analysts: Observe that a robust post-listing rally reflects positive sentiment and confidence in Crizac’s growth story .

-

-

-

Sprunki Incredibox brings a fresh twist to music-mixing fun, with new beats and visuals that keep you coming back. The Sprunki Phase Game is a must-try for creative gamers.